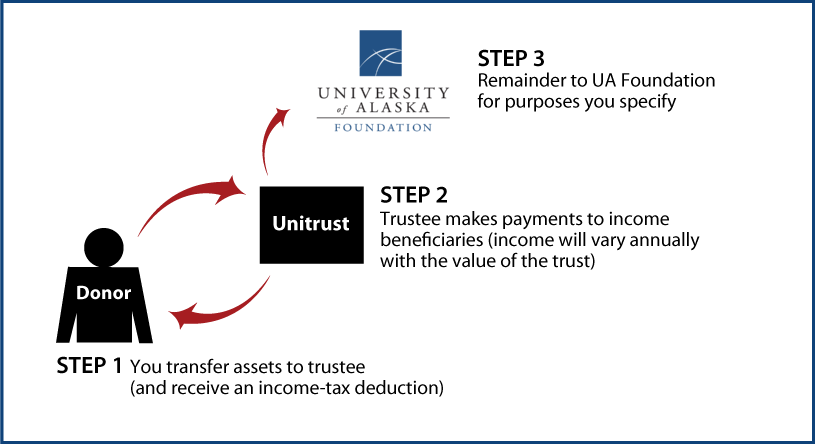

Charitable Remainder Unitrust

How It Works

- Create trust agreement stating terms of the trust; transfer cash or other property to trustee

- Trustee invests and manages trust assets and makes payments to income beneficiaries you designate

- Remainder to UA Foundation for purposes you specify

Benefits

- Payments to one or more beneficiaries, varying annually with the value of the trust

- Federal income-tax deduction for the charitable remainder value of your interest

- No capital-gain tax when trust is established; property is sold by the trust

- Trust remainder will provide generous support for UA Foundation

More Information

Request an eBrochure

Request Calculation

Contact Us

|

Harry Need, CFRE |

ANCHORAGE OFFICE |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer